Sourcing hydrogen for fuel-cell-electric trucks remains a challenge

There’s lot of talk about hydrogen as Canada’s fuel of the future. While there’s little doubt it will play a role in decarbonizing our economy, the pathway to hydrogen-powered transportation isn’t paved with soundbites or easy answers.

Hydrogen is the most abundant element in the universe. Stars, including the sun, are giant balls of hydrogen. But here on earth hydrogen is found in a compound form with other elements like oxygen (making water) or complex hydrocarbons such as natural gas, coal, and petroleum.

Separating hydrogen from its compound form is messy and complicated.

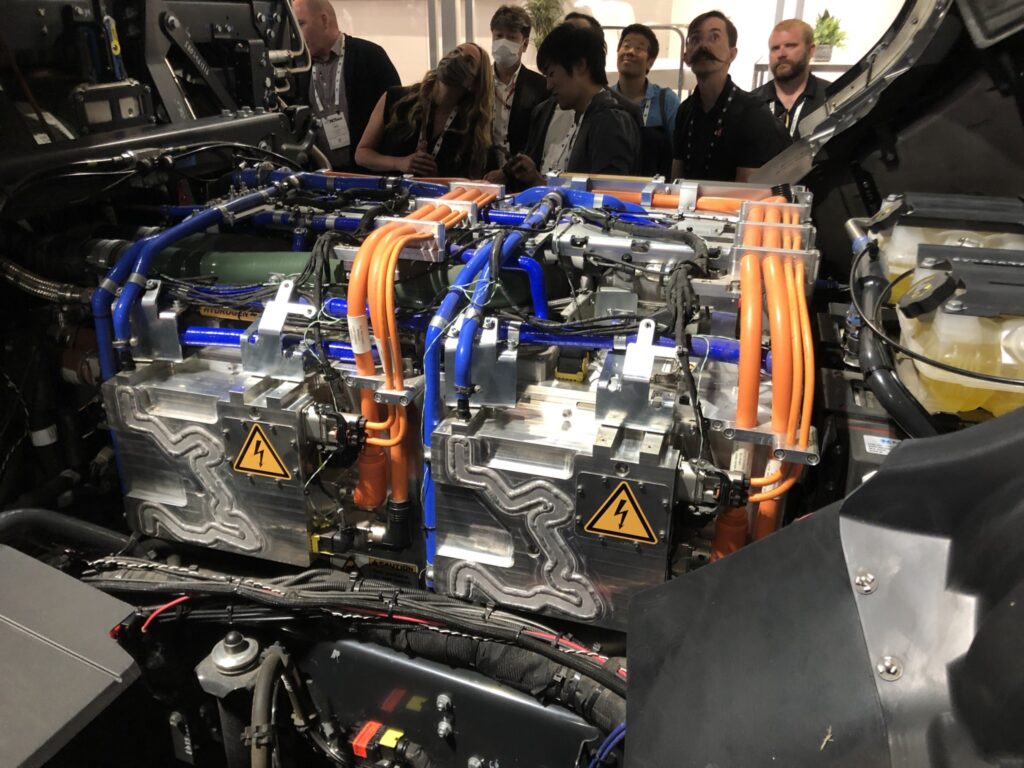

Hydrogen offers many benefits as an energy source for trucks, but the cost-benefit calculation is anything but clear right now. Hydrogen isn’t necessarily a fuel, per se, though it can be when burned in an internal combustion engine. When used in a fuel cell application, hydrogen is an energy storage medium. It functions more like a battery, retaining some portion of the energy used to separate it from the host compound. This energy can be stored and transported as a compressed gas or a cryogenic liquid.

Converting renewable energy to hydrogen

It’s this separation process we’re struggling with. The energy lost to the conversion process, especially electrolysis, renders it wasteful and inefficient. David Cebon, a professor of mechanical engineering at the University of Cambridge, outlined that inefficiency in a recent blog post.

“Converting renewable electricity into hydrogen via electrolysis [separating hydrogen from oxygen in water using an electric current], compressing and storing the hydrogen, and then running it through a fuel cell to generate electricity to drive an electric motor has an overall efficiency of around 23%. That means that 77% of the energy is wasted as low-grade heat through the energy conversion chain in a FCEV (fuel cell electric vehicle).”

Cebon goes on to say that for every 100kWh of renewable energy generated, around 69 kWh reaches the wheels of a battery-electric vehicle. “Consequently, the FCEV requires three times more renewable electricity to drive it the same distance as a BEV.”

That has consequences for any energy grid, especially a grid powered by fossil fuel. But harvesting wind, solar, and even hydro-electric power that might otherwise go untapped mitigates some of hydrogen’s inefficiency – unless battery-driven systems are competing for that energy.

“The FCEV requires three times more renewable electricity to drive it the same distance as a BEV.”

– David Cebon, University of Cambridge

Batteries are not without their own baggage, of course, given the environmental impacts of the mining and manufacturing processes needed to create the all-important cells.

Aside from electrolysis, hydrogen is also produced from hydrocarbon feedstocks such as coal, oil, or natural gas through steam methane reformation (SMR). Critics suggest this energy-intensive process pollutes more than using the fossil fuel outright. Depending on the source and the process, fossil-based hydrogen produced from natural gas emits around 10 kg of CO2 per kg of hydrogen, according to the Hydrogen Science Coalition.

Even carbon capture and storage (CCS) — which syphons CO2 from the gas stream, pressurizes it, and stores it underground – only captures about a third to half of the CO2. The Quest project in Alberta, for example, is estimated to capture around 45% of CO2 emissions. But that estimate also varies depending on a source’s view of CCS. While various reports show gross tons of captured CO2, they usually don’t say what percentage of the total output that represents.

Hydrogen color-coded classifications

We now have color-coded classifications for various hydrogen production processes. There’s gray, such as the gas created from feedstocks like coal and natural gas, and the blue classification applied to carbon capture and storage. Green hydrogen is produced using only dedicated renewable energy sources, such as wind, solar or hydroelectric power. Yellow, a less common term, refers to hydrogen produced by electrolysis using energy directly from the grid, no matter what the ultimate source may be.

Since hydrogen and battery-electric trucks are seen as tools to decarbonize trucking, we have to consider the sources of energy used in the pursuit.

Gray and blue hydrogen may be seen as viable options to help kickstart the hydrogen economy in the short term, but some environmental groups counter that fossil-fuel-derived projects amount to “greenwashing” and should be excluded from hydrogen production tax incentives.

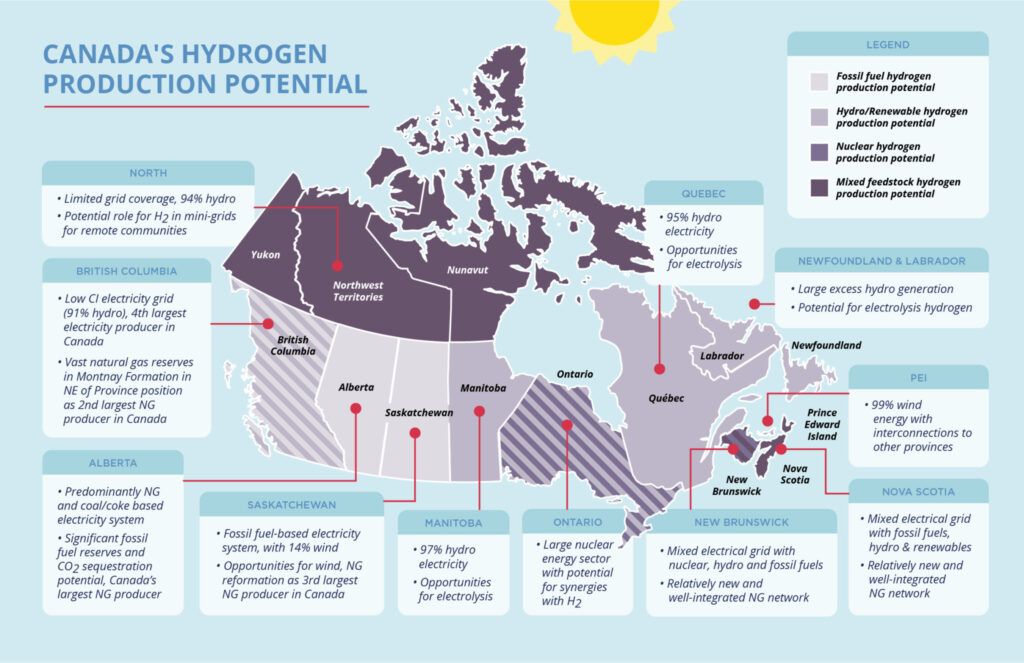

Green hydrogen, on the other hand, is the holy grail of energy sources for mobile applications like trucking. It can be compressed, stored, and is relatively easy to distribute. Yes, there are conversion losses, but they could be forgiven if the net result is a truly carbon-free, zero-emission energy source when looking from wells to wheels. And Canada is a leader on the green technology front, with several large-scale projects planned or being developed.

Canadian hydrogen projects

In early February, Nova Scotia approved a proposed green hydrogen project in Point Tupper, N.S. near Port Hawkesbury, on Cape Breton. A company called EverWind Fuels plans to produce hydrogen using renewable electricity from local wind-energy suppliers and water drawn from a nearby fresh-water lake.

The company says it will begin producing hydrogen by 2025, producing 200,000 tons for export per year. It will be mixed with nitrogen to create ammonia, which will be shipped in a liquid form to customers in Germany. The $6 billion project will ramp up to 1 million tons by the second year, powered by a 2-gigawatt windfarm to be constructed on nearby lands.

Another company, World Energy GH2, is developing a green hydrogen project in western Newfoundland and Labrador that will deliver approximately 250,000 tons of hydrogen per year using 1.5-gigawatt electrolyzers powered by a 3-gigawatt windfarm. That project is still in the environmental assessment phase but expected to proceed.

Quebec is a leading contender for green hydrogen production, but a recent announcement from Quebec’s energy and economy minister, Pierre Fitzgibbon, cast a shadow over possible developments. Published reports say several proposed green hydrogen projects would have to be shelved because of a lack of electricity.

Reports say the province had proposals for projects requiring up to 9,000 megawatts out of a total 23,000 megawatts identified for industrial projects. Backtracking somewhat, Fitzgibbon later issued a statement saying between 8,000 and 10,000 megawatts could be allocated to hydrogen projects by 2032.

Cummins electrolyzer in Canada

In January 2021, industrial gas producer Air Liquide opened a green hydrogen facility in Bécancour, Quebec, near Quebec City. It’s currently producing 8.2 tons per day (3,000 tons annually) from a 20-megawatt proton exchange membrane (PEM) electrolyzer supplied by Cummins. That facility is already serving nearby industrial customers.

“We can cool and liquify the hydrogen and economically transport it 500-1,000 miles by truck at a very competitive price,” said Michel Archambault, who was Cummins’ commercial director for hydrogen production in the Americas when he spoke with a group of journalists last June. (He has since left the company.)

Because Cummins’ electrolyzer technology is a modular solution, it’s scalable based on demand, and could well fit a behind-the-fence fleet fueling strategy, he said. For instance, two Cummins HyLYZER-500s could produce up to 2,000 kg per day — enough for 65 to 80 Class 6 trucks with 25 to 30 kg of hydrogen at a pressure of 350 bar (5,000 psi).

This shows trucking doesn’t need mega projects to establish hydrogen fueling infrastructure. But trucking, as a potential consumer of hydrogen, will represent a tiny fraction of what’s presently consumed by other industries. Mostly likely, trucking would be able to partner with providers who have excess capacity or install their own electrolyzers behind the fence. However, the six-to-seven-figure price tag for that technology is likely to dampen enthusiasm somewhat.

Hydrogen limits in trucking

So, where does all that leave the trucking industry? Judging by the presentations and audience questions during a recent webinar hosted by the Hydrogen in Trucking Working Group (under NRCan), Transport Canada’s Innovation Centre and FPInnovations’ PIT Group, there are many more questions than answers.

Patrick-Olivier Tremblay, senior sales director at Kenworth Maska, said his customers are asking about hydrogen and other non-diesel technologies, but admits he doesn’t have the answers. He told the audience his customers are aware of the incentive programs to buy this new technology, and they want to get in sooner rather than later, be he can’t supply all the answers.

“We have to train our sales force and service team to ensure the customers are successful in energy transition,” he said. “We need major investments in tooling and service bay conversion for those alternative vehicles. But mostly we need technical resources from the truck and powertrain OEMs, and from external people familiar with the technology.”

“The numbers from the U.S. evaluations aren’t valid here.”

– Marc Trudeau, PIT Group

And while there are questions aplenty about hydrogen in general, issues related specifically to Canada surface as well, such as how well hydrogen fuel cells will work with harsher climates and heavier trucks.

“Canadian fleets want to know what’s happening in this country, not in the deserts of Arizona and California,” said Marc Trudeau, manager of partner relations and business development at PIT Group. “We hear numbers reported by the OEMs for 80,000-pound loads in perfect weather, but Canadian fleet managers know that’s not how it will work in Canada. In the tests we have done so far, the fleet managers are right. The numbers from the U.S. evaluations aren’t valid here.”

Some of those questions could be put to rest later this year through the Alberta Zero Emissions Truck Electrification Collaboration (AZETEC) demonstration project that will see trucks pulling hydrogen-powered loads between Edmonton and Calgary for a full year.

Mike Gomes, Bison Transport’s vice president – maintenance, said the problem for much of the industry lies in the limited data around long-distance applications.

“The unfortunate piece to this is that a lot of the use case scenarios today are very short-duration trips. That’s not where the carbon emitters are, but we have to go there because that’s what technology supports today,” he said. “I think we’ll see a clearer picture of the potential through the AZETEC project. We are going to haul 140,000 pounds with an electric-drive vehicle, hydrogen-fuel-cell-powered truck in that project.”

When completed, the project will provide a benchmark for the feasibility of wide-spread adoption of hydrogen as an energy source for commercial transportation.

Global hydrogen demand

But analyses and projections by the International Energy Agency (IEA) – a forum representing 29 industrialized countries — suggest the challenge will be enormous.

As of 2019, the world consumed 115 million tons of hydrogen, the vast majority of which went to heavy industry, including steel making, petrochemical refining, and heating. Transportation of all types accounted for less than 10,000 tons. IEA says by 2030, transportation’s share is expected to reach 1.6 million tons, rising to 66.5 million tons by 2050, and almost 160 million tons by 2070.

Producing that much green hydrogen will be daunting. The IEA suggests around 300 megatons of hydrogen could be produced from electrolyzers in 2070, under what it calls the Sustainable Development Scenario. This would require 13,750 terawatt/hours of electricity — equivalent to half of global electricity generation today, the agency says. By 2070 electrolyzer capacity would have to rise from 170 megawatts today to more than 3,000 gigawatts.

In other words, reaching the net-zero targets in 2050 will require a six-fold increase in hydrogen production over current output.

Don’t put your diesel out to pasture just yet.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Great article Jim. Answering many of the questions I have been wondering about. It’s a similar situation with EV’s there simply isn’t enough power currently available for a mass move away from fossil fuels. Never mind our current power grid needs massive upgrades to deliver the electricity to the end users. Big challenges ahead and it doesn’t seem they are being addressed fast enough by our leadership.