Economic Trucking Trends: Pent-up truck demand remains, why May matters to spot market

This week took us to Denton, Texas, where Peterbilt hosted thousands of dealers, customers and press for the unveiling of its new Model 589 classic-styled conventional.

I took advantage of the opportunity to ask Jason Skoog, Peterbilt general manager and Paccar vice-president, for a market update.

“The market is still very strong,” he said. “There’s a ton of demand for trucks. We’re basically sold out for this year.”

The truck maker has kept a careful eye on publicly traded fleet earnings and while they show obvious signs of a market downturn, Skoog said most are still on pace for their fourth best year ever. “Not a bad year,” he said. “Conditions are different than what they were at the end of 2021 and early in 2022.”

However, he said body upfitters have longer backlogs than the truck builders themselves, attesting to the strong demand for vocational trucks needed for infrastructure investments. “The only reason our backlog is not longer is we are not taking orders for 2024,” Skoog said.

And good news on the supply chain front: Skoog said the red-tagging of incomplete units continues today, but the practice is not nearly as bad as it was. Turn time, he said, “is tremendously better” compared to last year.

Shallow recession ahead?

Skoog’s optimism about the Class 8 truck market was echoed this week by industry forecaster ACT Research, which has observed a “clear softening in big fleet profitability and other ancillary metrics,” but pent-up demand has kept OEMs busy this year.

ACT warns this demand could become exhausted later in 2023, as lower rates, higher equipment and borrowing costs, improved equipment availability and sinking profits all weigh on carriers’ appetite for new trucks.

“Even as the Class 8 market comes under increasing pressure, van trailer demand continues to enjoy secular support from the move to ‘power-only brokerage,’ which has big fleets and logistics companies looking to boost trailer to tractor ratios to bolster spot market productivity,” said Kenny Vieth, ACT’s president and senior analyst.

“We’ve spent most of the past year warning about a potential recession. Admittedly, the economy has proven more resilient than initially envisioned. That said, we think broader economic conditions are softening, and we reiterate our cautious view, including our forecasts for slowing second half 2023 production rates. We continue to expect a shallow recession to materialize, centered on mid-year.”

An immediate wildcard in ACT’s forecast is the U.S. debt ceiling, which could hinder business investment, push interest rates higher, and induce a “deeper recession sooner.”

U.S. carriers contracting

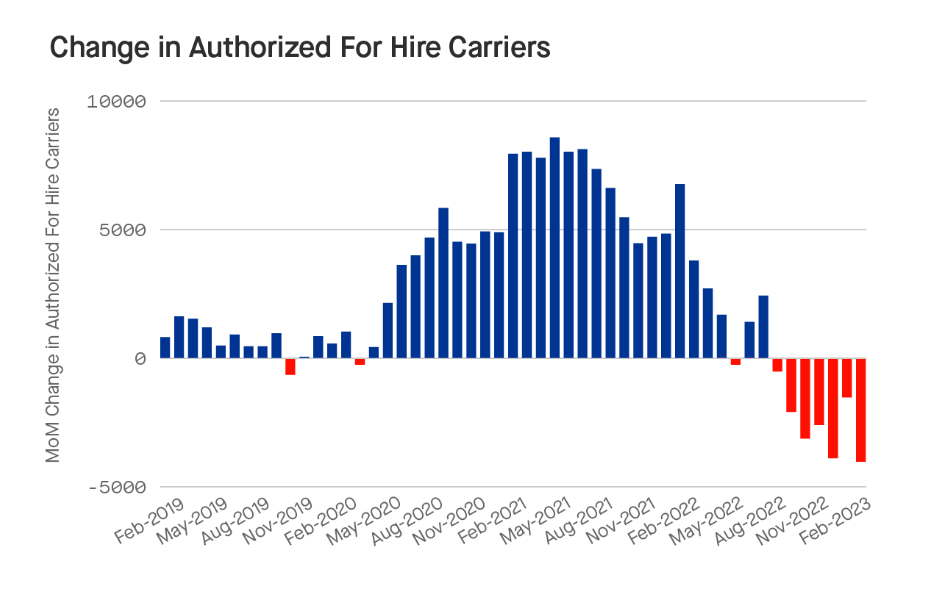

Telematics provider Motive (formerly KeepTruckin) released its May Monthly Economic report this week, and it shows what’s happening to new company formations in the U.S. They dropped 17% in April compared to March, but Motive says it’s likely simply a rebalancing of capacity since there was a staggering 27% year-over-year explosion in trucking startups in 2021 – nearly 5x the 10-year average of 5.6%.

“Carrier start data is also showing resilience, with starts remaining in line with the rolling six-month average,” Motive reported. “This indicates there are still businesses seeing enough opportunity to enter the market. It’s critical to monitor Q2 to see if the recession is indeed a recession or a reversion to the mean.”

Overall, Motive reports, the freight market is shrinking but carriers are still forming in line with six-month averages.

Freight continues fall

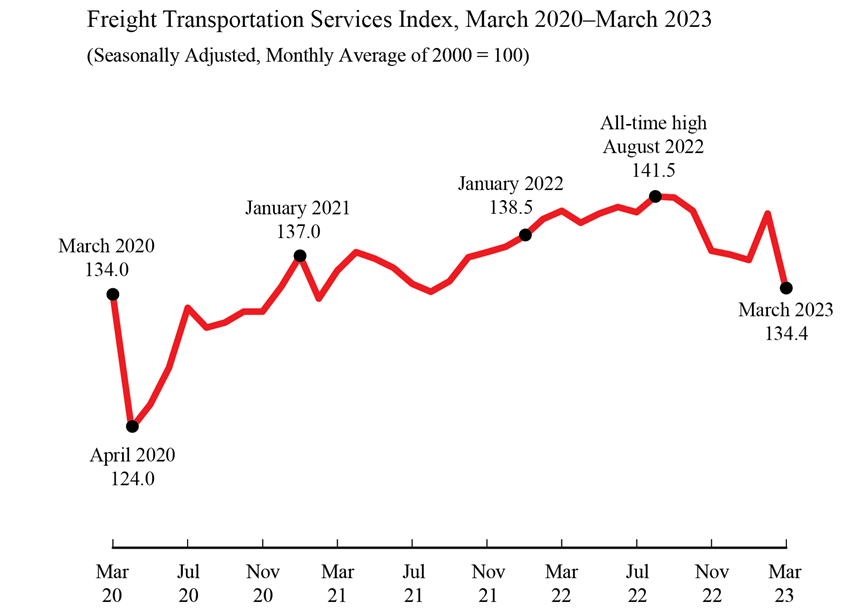

The U.S. Department of Transportation released its March freight index this week, which reflected the largest decrease in freight volumes since the beginning of the pandemic in April 2020. This was its seventh decrease in nine months, for an overall decrease of 4.5% since June.

For-hire freight shipments in March were 41.5% higher than the low in April 2009 during the Great Recession, and 5% off the historic peak reached in August 2022. Year to date, U.S. for-hire freight shipments were down by 2% in March compared to the end of 2022.

How about the spot market?

DAT Freight & Analytics reported that truckload freight volumes declined and average national spot rates for dry vans and reefers decreased for the fourth straight month in April. Truckload volumes were down 15.5% in April from March (vans), -16.3% (reefer), and -13.7% (flatbed).

A drop from March to April isn’t unusual, DAT reports, but those van and reefer volumes were the lowest since February 2021 when volumes were impacted by major winter storms.

“May will be pivotal for shippers, brokers and carriers,” said Ken Adamo, DAT’s chief of analytics. “After a challenging first four months of the year, we expect to see the effects of seasonality on freight volumes and rates. The question is how sustainable those effects will be.”

National average spot van rates were $2.06 (all figures USD) a mile, down 10 cents from March and 71 cents year over year. Reefer rates dropped nine cents a mile to $2.41, and flatbed four cents to $2.67 per mile.

May matters

Those hauling contract freight are faring better, with the spread between contract and spot rates rising to near all-time highs of 62 cents/mile for van loads, DAT reports.

Adamo called the spread between spot and contract rates “an indicator of where we’re at in the freight cycle — the balance of bargaining power among shippers, brokers and carriers.”

For the gap to close, two things need to happen: “One, the supply of trucks on the spot market needs to diminish, which unfortunately means more carriers exiting the market. Two, there needs to be higher demand for trucks — in other words, shippers with more loads than they planned for.

“In 2016 and 2019, it was precisely the third week in May when the spot market entered a recovery phase after prolonged declines and stagnation,” he continued. “Seasonality kicked in and shippers needed more trucks to move fresh produce, construction materials, imports and summer and back-to-school retail goods. If we see an uptick in demand before Memorial Day, it will be a welcome sign for owner-operators and small carriers as we head into the summer and fall.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.