Economic Trucking Trends: U.S. holiday brings positive signs for freight, equipment demand

The U.S. Independence Day holiday has come and gone, and with it came some encouraging signs on several fronts concerning freight and equipment.

Trucking added jobs while there continues to be a sharp increase in carrier revocations, suggesting a rebalancing is slowly occurring with independent operators packing it in and potentially returning to larger fleets. Spot market rates were surprisingly resilient over the week leading up to the holiday – was it a sign of a potential recovery, or at least a bottoming of spot market rates?

Truck visits to Top 50 retailers over the holiday week were also surprisingly strong. Does this signal a drawdown in retail inventories, and is it potentially another sign the freight markets have bottomed? And lastly, ACT Research is upping its outlook for equipment sales and production for the remainder of this year and next. Let’s get into it…

Capacity rebalancing happening…sloooowwlly

The U.S. trucking industry added 2,300 jobs in May, according to ACT Research’s take on the latest Bureau of Labor Statistics data. The industry analysts feels the industry continues to add jobs despite ample capacity because carriers are focused on driver retention, despite record rate reductions.

Tim Denoyer, ACT Research’s vice-president and senior analyst, said the job gains are “defying gravity, for now.”

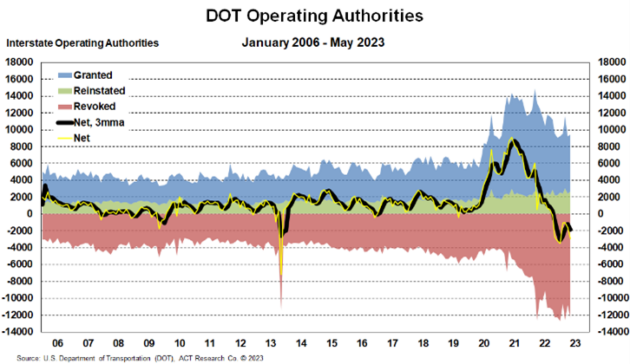

“Some of this probably came from the owner-operator community, where net revocations of DOT operating authorities continue apace,” he said. “We estimate another 12,400 total revocations of operating authority and 2,950 net revocations in May, bringing the total contraction in the industry since last October to over 15,000 fleets.”

This reflects a capacity rebalancing, with drivers moving back to larger carriers, in some cases abandoning their own authorities. As freight demand recovers, ACT says the pieces are in place for a recovery.

“The spot market is continuing to rebalance with net revocations still at record rates. Even as the overall market is still on the loose side, the pendulum has started to swing,” Denoyer concluded. “The trajectory of spot rates has changed in the past couple of months, and we think demand fundamentals are likely to improve from here as we pass the worst of the destock. So, more freight market dynamics are in store down the road.”

Spot market rates holding up

Conditions are improving on the U.S. spot market, according to the latest data from Truckstop and FTR Transportation Intelligence. Decreases in spot market van and reefer rates for the week ended July 7 declined, as expected, but less than expected.

The dry van rate decline for the week was one of the lowest ever for the July 4 holiday week, while declines in reefer spot rates were the smallest since 2020 and lower than typical for the holiday week.

Flatbed rates actually increased for the week, bucking tradition, and as a result overall spot market rate decreases were among the lowest all-time for the July 4 holiday week.

“The relatively strong rate performance might indicate some firming of the spot market, but it also arguably could reflect a market that is already near the bottom and, thus, has little downside to give up,” Truckstop and FTR reported.

More good ‘holiday’ news

In its latest economic update, telematics provider Motive, noted a surprisingly high number of retail store visits by trucks leading up to the July 4 weekend. The company said it’s the “first positive sign since the current freight recession began.”

Truck visits to Top 50 retailers jumped 3% in the week leading up to the holiday, and were up 9% from the end of May. “The surge is still well off the highs seen in previous years, but nonetheless was stronger than expectations in the weeks leading up to the holiday,” Motive reported.

What to make of it?

“This late surge ahead of peak retail and freight season is the one of the first positive signs amid the freight recession, but there’s still a steep hill to climb for the freight market to recover as second half demand expectations remain muted,” the telematics company wrote. “It may also indicate that retailers are taking advantage of stronger supply chains to increase inventories in shorter windows due to continued slumps in consumer demand.”

Outlook for truck sales improves

On the equipment front, ACT Research is now calling for higher 2023 and 2024 Class 8 retail sales and production volumes over last month’s estimates. An anticipated drop-off in Q4 equipment sales and build capacity “no longer looks likely,” ACT claims, thanks to continuously improving macro-economic conditions.

ACT is also raising its outlook for GDP, medium-duty, and trailer build forecasts.

“The upward forecast revisions reflect our view that macro-economic positives will increasingly outweigh negatives as the calendar advances into 2024,” said Kenny Vieth, ACT’s president and senior analyst. “Support from consumer durables, and perhaps even capital equipment spending, will be a plus. These are sectors that usually have steep declines in a traditional recession, but have held well thus far in 2023, and we expect that momentum to continue into 2024. Next year inventory accumulation should inflect to a freight tailwind, from the current destocking headwind.”

He concluded, “Weaker orders in 2023 should lead to lower, if historically shallow, production declines in 2024. Our now shallower decline in 2024 reflects a higher Q1 production starting rate, slightly higher economic growth, the notion that some customers may choose to replace equipment more liberally than they might otherwise in advance of the EPA’s expensive 2027 emissions mandate which is likely to see vehicle demand outstrip the industry’s ability to supply, and for the same reasons, a willingness by dealers to carry more inventory through the 2024’s period of slower activity.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.