More investment needed to meet electric truck charging requirements

Canada’s ambitious timelines to decarbonize the nation’s medium- and heavy-duty trucks is achievable, but will require the fast deployment of charging infrastructure and much more investment than has been allocated to date.

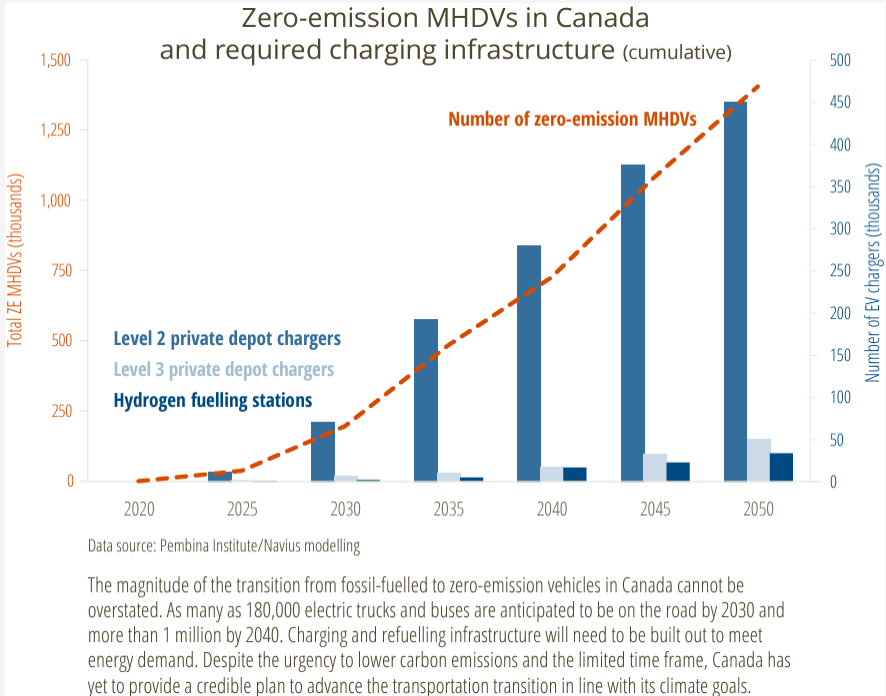

So says a report from the Pembina Institute, in a report titled Zero-emission MHDVs in Canada and required charging infrastructure. The report recognizes the need to decarbonize the goods transport sector, as medium- and heavy-duty trucks account for 37% of overall transportation-related GHG emissions.

The segment is expected to surpass the GHG output of smaller vehicles by 2030. Yet, the federal government’s investment in providing electric charging infrastructure for medium- and heavy-duty trucks lags what’s needed. The Pembina Institute says that to date, the feds have committed only $1 billion of the $5 billion needed to support the anticipated number of electric trucks on the road by 2030.

Pembina modeling suggests that by 2030, the segment will require: 70,000 Level 2 private depot chargers, increasing to 450,000 by 2050; 6,500 Level 3 public chargers by 2030, increasing to 50,000 by 2050; and 2,000 hydrogen fueling stations by 2030, increasing to 30,000 in 2050.

Is it even possible? We asked that question to Adam Thorn, director of the Pembina Institute’s transportation program and an author of the report.

“I absolutely do think they are doable,” he said of the federal government’s timelines, calling for 35% of new medium- and heavy-duty truck sales to be zero emissions by 2030, and 100% by 2040. “But I think they have to be done in a very smart way. We’re advocating for a phased-in approach. We need to focus on those areas in which we have some low-hanging fruit.”

Smaller vehicles first

This means focusing initially on applications that are easy to electrify today, such as smaller delivery vehicles with predictable routes and frequent returns to the home depot for charging.

“They’re ready to go now,” Thorn said of these vehicles, mainly in the Classes 2B to 5 categories. “They tend to have relatively short, predictable routes. They return to the barn at the end of the day so there’s lots of opportunities there for that charging. By focusing on those vehicles that are ready to go, we think we can move very quickly.”

Charging infrastructure for those vehicles will primarily be installed at depots, but the report suggests the federal government assist in funding that infrastructure and not expect industry to bear the entire cost.

“One of our recommendations was to carve out a specific piece of the Zero Emission Vehicle Infrastructure Program for those types of vehicles, and depot charging specifically,” Thorn said. “Then what we’re hoping is the learnings, the innovation, the technology development in those segments will trickle up to those heavier categories.”

Buying time

Aggressively targeting smaller commercial vehicles also buys time, he added, for fleets operating heavier trucks while still progressing toward the federal government’s prescribed timelines.

To date, much of the government’s focus has been on providing public charging infrastructure for passenger car vehicles. Thorn acknowledged the trucking segment will need more attention going forward.

“We want to make sure the MHDV (medium- and heavy-duty vehicle) sector isn’t left behind or forgotten about when we’re talking about that [funding],” he said. “But it’s hard to get the public’s attention to talk about the medium- and heavy-duty vehicle sector.”

When deploying public charging stations for trucks, the Pembina report suggests focusing initially on freight corridors, such as Toronto-Montreal.

“We can focus on those areas in which there’s a lot of trucking,” reasoned Thorn.

The report recommends installing at least one charging and hydrogen refueling station every 60 km along key sections of the Trans-Canada Highway and the Ontario-Quebec Continental Gateway by 2030. The distance between hydrogen refueling stations should be less than 150 km, the report suggests, with each having capacity greater than 2 tonnes/day.

There are also questions as to whether the electric grids in Canada can support the widespread electrification of medium and heavy trucks.

“If all trucks were to convert today, no,” Thorn admitted, when asked if the electric grid can support the transition. “We’re going to need more capacity…it’s a big challenge, but we’ve certainly done that before. If you look at the total growth of the grid for the last 120 years, it’s a pretty impressive curve. I think it’s absolutely the case that we’ll be able to develop that additional capacity.”

While government funding will play a significant role if the trucking industry is to meet the federal government’s timelines, fleets too will need to invest. And those investments will be sizeable.

Asked how smaller fleets, in particular, will be able to keep up, Thorn said: “I understand their reluctance. Many small fleets simply don’t have the capacity for this. So, we’re seeing the large fleets – Purolator, FedEx – begin to do this because they can take on some of that risk and they have that capacity. As those big fleets begin to roll out, we’re going to see this industry mature. We’re going to see it in more vehicles and technology is going to develop. We’re going to see more infrastructure. I think taking a longer view is something we need to do.”

The full report can be viewed here.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.