Economic Trucking Trends: Shippers benefit from lower fuel prices, van rates get a bump

There’s good news for shippers this week, thanks to decreasing fuel prices. Dry van rates on the U.S. spot market also received a much-needed boost while reefer rates fell. All told, Truckstop reports the worst Market Demand Index on the U.S. spot market since May 2020. Also, expect weak demand for aftermarket parts for a variety of reasons outlined below.

Let’s get into the latest look at economic trucking trends …

Shippers enjoying improving conditions

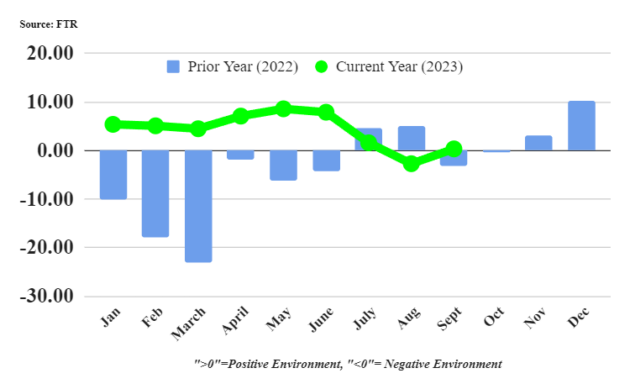

FTR’s Shippers Conditions Index (SCI) improved in September, moving into positive territory with a reading of 0.35, up from -2.7 in August. Lower fuel prices were to thank, as other market conditions were stable.

“The neutral reading just above zero shows a relatively stable result, but it moves the index back into positive territory on an easing of diesel prices,” said Todd Tranausky, vice-president of rail and intermodal with FTR. “Otherwise, the market is little changed. Moving forward, it is likely that diesel prices will determine what the change in the index will be for the next few months.”

Spot market improves for dry van haulers

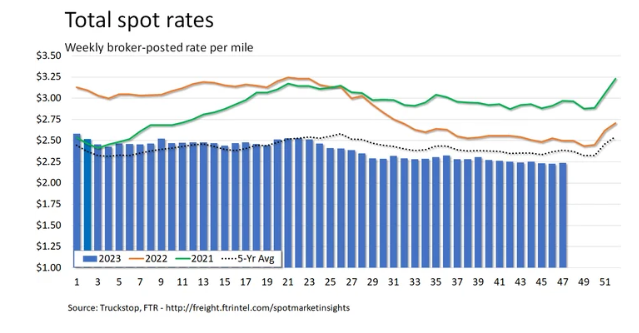

Truckstop and FTR Intelligence reported some expected – but late-arriving – seasonal strength for spot market van haulers for the week ended Nov. 24. Van rates rose the most in any week since May, and it was the first week-over-week increase in seven weeks.

However, refrigerated rates decreased by about the same as dry van rates went up. While reefer rates often decrease Thanksgiving week, this year’s drop was larger than usual, Truckstop reported. This after the week prior to U.S. Thanksgiving failed to provide the usual seasonal bump.

Truck postings were down on the week, but load postings fell further, dropping the Market Demand Index to 33, marginally below its usual performance for the week and the lowest it’s been since May 2020.

Aftermarket parts sales sluggish

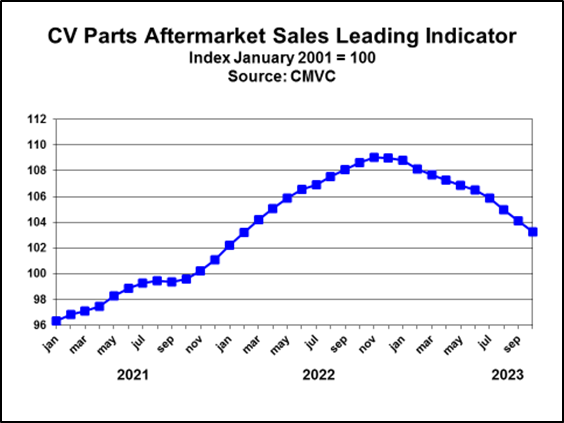

CMVC provides the Parts Aftermarket Sales Leading Indicator (PLI), which fell for the 11th consecutive month in October. This means there is likely to be lower aftermarket parts sales in the coming months.

“The commercial vehicle population is expanding, but a host of factors are weighing on parts aftermarket sales,” said Chris Brady, president of CMVC. Fleets are upgrading equipment, so average ages are returning “back to norm”. There are more idled trucks in the used truck market, and a soft freight environment means they wait longer for buyers. And lower capacity utilization means the truck population is depreciating at a slower rate.

“In the short-term, these factors are more than offsetting an expanding commercial vehicle population resulting in lower parts aftermarket sales,” he said.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Reefer rates are 42 cents CD or 30 cents U S below cost of most return rates to Canada and many loads inside of Canada. I see many small companies that were based on lease ops and owner ops closing down. This was caused by too much expansion in truck numbers in 2021 . We also need to limit foreign workers including students and truck drivers in the next boom cycle to 8 months work contract from April to Dec 17 . I see many truck drivers who have came on work permits that are now in trouble financially and had to send their family back to India.