Economic Trucking Trends: Tough conditions continue for fleets, particularly smaller ones

Overall trucking conditions plunged deeper into negative territory according to FTR’s Trucking Conditions Index, thanks to rising fuel prices and softer freight demand. No surprise, then, that the latest week on the spot market was an ugly one, especially for those seeking dry van and refrigerated freight.

Trailer orders kicked off peak buying season strong, however, showing fleets are still eager to replace equipment and take advantage of 2024 build slots to do so.

However, ACT Research issues a word of caution regarding the Class 8 market, as private fleets seem to be powering the buying and for-hire fleets are “hoarding labor” as they try to hang onto drivers as they await improved freight conditions. Lots to digest…

Trucking conditions dive

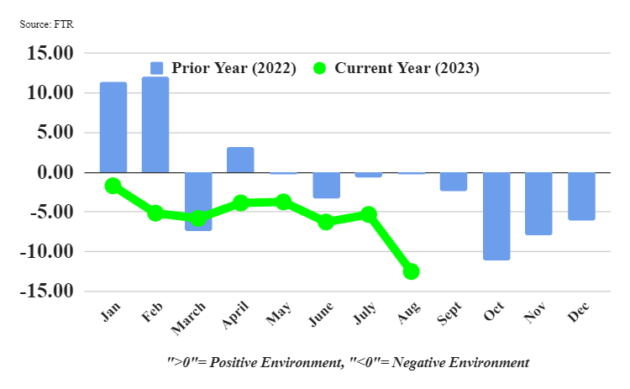

Overall trucking conditions dove deeper into negative territory in August, according to the latest Trucking Conditions Index as compiled by industry forecaster FTR. The index plunged from -5.34 in July to -12.54 in August thanks to sharply higher diesel prices and weaker freight volumes.

The August reading was the worst for truckers since April 2020, though FTR notes the higher fuel costs will disproportionately hurt smaller carriers on the spot market than larger ones hauling contract freight with fuel surcharges. FTR doesn’t anticipate the index will turn positive until late 2024.

“Market conditions for trucking companies look solidly negative through the first quarter of next year as we forecast no significant strengthening of capacity utilization or freight rates, and freight demand is stagnant,” said Avery Vise, FTR’s vice-president, trucking.

“A major question is whether consumer spending will remain as strong as it has been in the face of inflation, higher financing costs, and the resumption of debt service of student loan payments [in the U.S.]. Freight demand is more likely to trail our forecast than to exceed it, so any near-term improvements in market conditions for carriers would likely come from a sharp drop in driver capacity. Small carriers continue to exit the market in high numbers, but aside from the LTL sector, larger carriers so far have absorbed much of that capacity. Diesel price volatility and the lack of any near-term strength in spot rates could accelerate carrier failures and tighten capacity.”

Trailer orders spiked in September

September marked the first month of peak order season for new trailers, and buyers lined up to the tune of 31,300 orders, according to preliminary data from ACT Research. It was a 19% increase from last September, and, once seasonally adjusted, up about 95% from August’s easy comparisons.

“Preliminary net orders, at 28,700 seasonally adjusted, were 95% higher sequentially,” said Jennifer McNealy, director commercial vehicle market research and publications at ACT Research. “While this certainly is a welcome sign for the industry, and the first time in 2023 that year-over-year comparisons have been positive, one month of robust orders does not guarantee the full year. It’s still too early in the new year order season to call.”

She added: “The data continue to provide mixed messages, with cancellations remaining elevated, driven primarily by the van segments, both dry and reefer, even as backlogs remain at healthy, albeit shorter, levels. In August, the backlog-to-build ratio was north of five months in aggregate, with some specialty segments having no available build slots until the beginning of 2025. We’ve been hearing that order discussions were occurring, and it looks like quotations are beginning to convert to ‘booked’ business.”

ACT waves caution flag

While fleets seem ready to secure new trailer build slots for next year, ACT Research is also warning that weak freight fundamentals combined with softer demand for new trucks are a sign to be cautious going forward.

Kenny Vieth, ACT’s president and senior analyst noted that there are mixed messages concerning Classes 5-8 order activity, with strong pent-up demand driving vocational orders but weakness in Class 8 tractor demand.

“Current weak freight fundamentals and largely sated pent-up tractor market demand make the case for caution,” Vieth said.

“Along with better-than-expected economic conditions, expectations were for spot rates to rise toward the end of this year, which certainly hasn’t yet materialized. That is due, at least in part, to the quirk of private fleets continuing to add capacity even in the face of low rates, following significant service disruptions during the pandemic. In conjunction, ‘labor hoarding’ is occurring among larger fleets, and anecdotally, those fleets are being as creative as possible to maximize driver pay even as they drive less, contributing to the bounce along the bottom.”

Continued weakness for spot rates

And how about those spot market rates? Loadboard Truckstop showed rates eased nearly 1% for the week ended Oct. 13, to their lowest levels since July 2020. Reefer rates fell for their sixth consecutive week, while dry van rates fell more sharply than in four weeks.

Flatbed rates ticked up slightly from the previous rate, surpassing reefer rates for the first time since late July. Flatbed rates remain near their August low, refrigerated rates are about 19 cents from their April bottom, and dry van rates are about 10 cents above their May lows.

Load postings declined in the most recent week, while truck postings increased, resulting in a Market Demand Index of 53.4 – the lowest level seen since mid-August.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.