Economic Trucking Trends: Freight headwinds, worsening trucking conditions, and another supply chain disruption

It continues to be a tough go for trucking companies, according to industry indices, and now there’s another supply chain disruption that threatens to impact the ability of retailers to stock inventories ahead of the holiday season.

The Panama Canal is the source of the latest supply chain issues, with the authorities there limiting traffic to conserve water due to drought conditions. The trailer market offers some reason for optimism as cancellations have slowed and backlogs continue to be worked through.

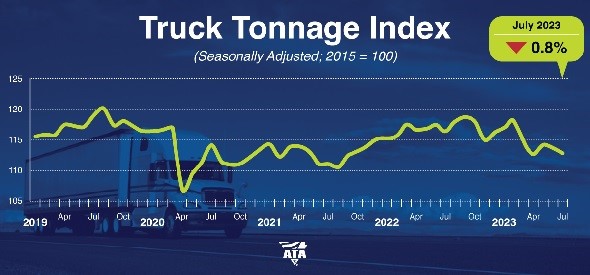

For-hire truck tonnage faces headwinds

U.S. for-hire truck tonnage pulled back 0.8% in July, on the heels of a 0.3% decline in June, according to the latest info from the American Trucking Associations (ATA).

“Headwinds for freight remained in July, pushing the truck tonnage index lower,” said ATA chief economist Bob Costello. “As has been the case for several months, a multitude of factors have caused a recession in freight, including sluggish spending on goods by households as consumers traveled more and went to concerts this summer. Less home construction, falling factory output and shippers consolidating freight into fewer shipments compared with the frenzy during the goods buying spree at the height of the pandemic are also significant drags on tonnage.”

Year over year, tonnage was down 3% in July, marking the fifth straight y-o-y decrease.

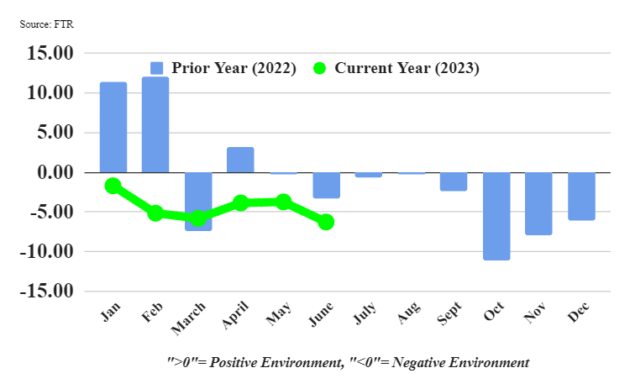

Trucking conditions reflect Great Recession

It’s no surprise that with truck tonnage falling, truckers are continuing to see weak conditions. The FTR Trucking Conditions Index (TCI) for June fell to -6.29, down sharply from the -3.75 reported in May and the worst reading since November.

The negative reading reflects “modestly weaker market conditions for carriers,” FTR reported this week. Freight rates were “slightly less negative” but other factors deteriorated.

“Based on our assessment, for-hire trucking companies have already faced the longest period of consistently unfavorable market conditions since the Great Recession,” said Avery Vise, FTR’s vice-president, trucking. “We expect negative TCI readings to continue for nearly a year longer and little, if any, improvement until early 2024. As we have noted before, the challenges are not uniform as the current market is hitting small carriers much harder than larger ones, especially considering the recent upturn in diesel prices.”

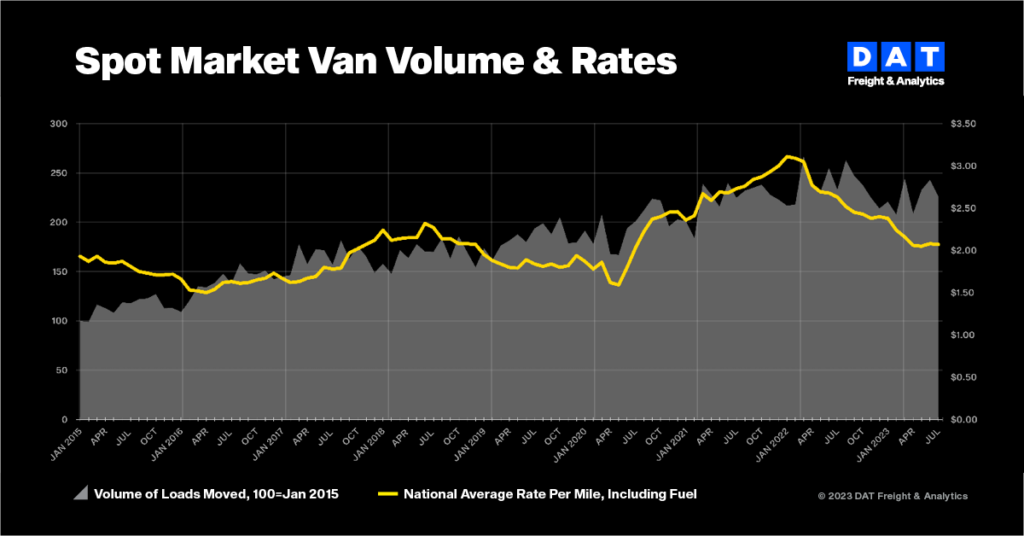

Spot market rates see summer chill

Those carriers reliant on the spot market continue to have a rough ride. June gains in truckload freight volumes and spot rates for dry van and reefer loads vanished in July, according to DAT Freight & Analytics.

Van volumes pulled back 7% in July, with reefer demand down 3.4% and flatbed down 12.8%.

“Shippers faced service disruptions at the ports and in the less-than-truckload sector but were able to secure van capacity without causing the needle to move on spot rates and volumes,” said Ken Adamo, chief of analytics.

DAT’s benchmark spot rates dipped in July, reflecting flat demand. The spot van rate was $2.07 (all figures U.S.), down a penny from June and 56 cents below July 2022 levels. Reefer rates fell 3 cents and flatbed rates dove 7 cents a mile.

“Spot rates, as a reminder, are ‘all-in’ rates, meaning no separate fuel surcharge to help mitigate the risk of fuel price fluctuations. You have to negotiate each individual load with fuel and operating costs in mind, which is not always easy,” Adamo said. “The sudden increase in fuel prices is testing the wherewithal of small carriers at a time when freight volumes are in a seasonal lull.”

Taking a look at more recent weekly data, Truckstop and FTR Transportation Intelligence indicated the week ended Aug. 18 showed continued softening in the overall spot rate environment, though in line with seasonal expectations.

The bright spot was reefer, with rates rising to their highest level since the end of June. Flatdeckers continue to feel the brunt, with rates down for the 10th time in 12 weeks and reaching their lowest level since August 2020.

2024 trailer build slots opening

ACT Research is “cautiously optimistic” about the trailer industry’s prospects for 2024.

“In addition to an improved longer-term outlook, nearer-term, general business conditions and material supply chains remain on par with July levels in the face of continued strong trailer output,” reported Jennifer McNealy, director, commercial vehicle market research and publications at ACT Research.

“Supply chain issues have essentially normalized, and OEMs continue to report smaller, more manageable, and less impactful disruptions.”

Production is outpacing order intake, allowing trailer makers to work down backlogs to the tune of 15% year over year. Cancellations slowed suggesting fleets still need trailers, though are not clamoring for them as they were last year.

“Fleet commitments improved in July but were still somewhat mixed. Total cancels dropped to 1.7% of backlog, following two months of elevated activity,” McNealy said. “Some OEMs have told us customers are cutting back on their anticipated order appetite for this year and next, with fewer customers remaining on the sidelines to pick up near-term build slots as they become available. Clearly, the demand dynamic is shifting.”

ACT has upped its trailer market forecast, thanks to an economy that continues to exceed expectations, higher GDP and freight forecasts and more normalized supply chains.

McNealy concluded: “As part of our recent trailer-maker survey, we asked about 2024 orderbook openings and dealer inventory levels. Based on their responses, it appears that about 35% of the industry’s Q1 2024 books have opened, with limited slots available beyond that.”

Trouble in Panama

This is what we needed – another supply chain disruption! This time it’s the Panama Canal that’s causing the backlog. U.S. retailers are seeing wholesale inventories dwindle and may be nervous about ongoing restrictions in the Panama Canal that are reportedly limiting throughput ahead of the Christmas inventory stocking season.

“Ongoing challenges at the Panama Canal are making existing worries for industries even worse. New industry information shows that the U.S. economy’s consumer spending has seen an uptick, which is good. With inventories falling and demand expected to rebound, the Panama Canal, which carries 40% of container traffic from Asia to Europe, is likely to experience increased pressure,” said Christian Roeloffs, co-founder and CEO of Container xChange.

The chokepoint in Panama is caused by the Panama Canal Authority implementing water conservation measures in response to drought. Vessels are experiencing prolonged wait times and capacity limitations.

It’s estimated about 200 vessels are currently waiting to transit through the canal, with wait times peaking at 21 days. Container xChange says 40% of U.S. container traffic is channeled through the canal.

“These supply chain disruptions are expected to reverberate throughout the industry,” said Roeloffs.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

With higher interest rates and drivers demanding higher wages to cover housing shortage costs. You will see more tractor and trailers orders cancel. We have lost 5000 units and we still have too many trucks and more units are now available if companies want to take over the loans on units purchased new in the past 26 months

We need a program in ont and Quebec to insure new drivers and the trucking companies need to help with training costs. Also a plan to keep experience truck drivers from leaving trucking