Economic Trucking Trends: Signs of life in spot market, but full recovery will take time

It was a busy week with mixed signals coming from various economic indicators. Motive reported a notable spike in truck visits to retail facilities, signaling bloated inventories have finally been depleted and restocking efforts have commenced.

The spot market improved on both sides of the border, but in the U.S. refrigerated haulers were the main benefactors with the Thanksgiving holiday looming. But ACT Research notes a full recovery will take time. More capacity must leave the industry and robust Class 8 truck order activity is a cause for concern as the last thing needed in this environment is more trucks!

We’ll close out with Kriska COO David Tumber’s synopsis of the current market.

Retail freight demand spikes, carrier bankruptcies continue

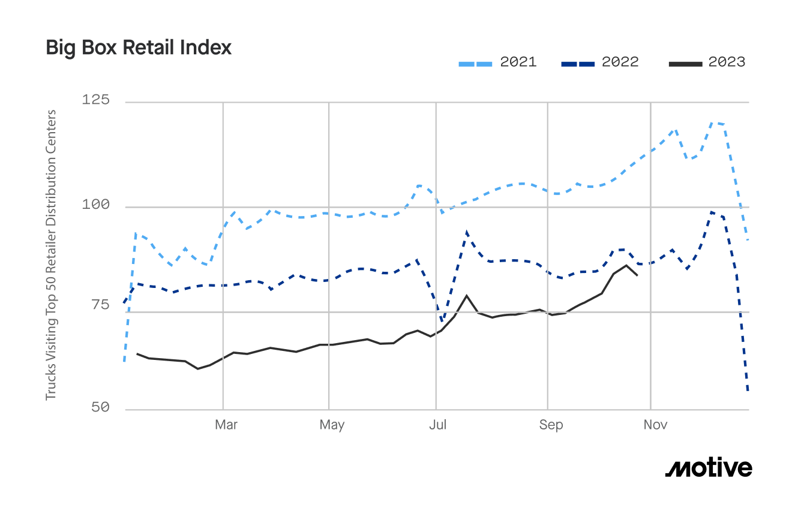

Motive released its November Monthly Economic Report this week, showing a surge in commercial vehicle visits to big box retail sites in October, signaling that retailers are ramping up restocking activities ahead of the holidays. October’s jump closed much of the gap from 2022 levels, which is good news for truckers, as it would suggest retailers have worked through bloated inventories.

Motive geofences big box retail facilities and tracks trucking visits to those sites to get a handle on retail freight demand. The index jumped 7.6% in October, with those selling durable goods such as appliances and furniture jumping 8.6% over September levels. Such visits are now just 4% off last year’s pace, much better than the 15% decline seen in June.

“It’s likely that instead of indicating overall higher demand, large retailers are returning to more normal inventory management,” Motive concludes. “They’re bringing in more stock as the holidays approach compared to the tighter stocking windows we’ve seen this year. Overall, we maintain our prediction that November will see retail visits exceed those from 2022.”

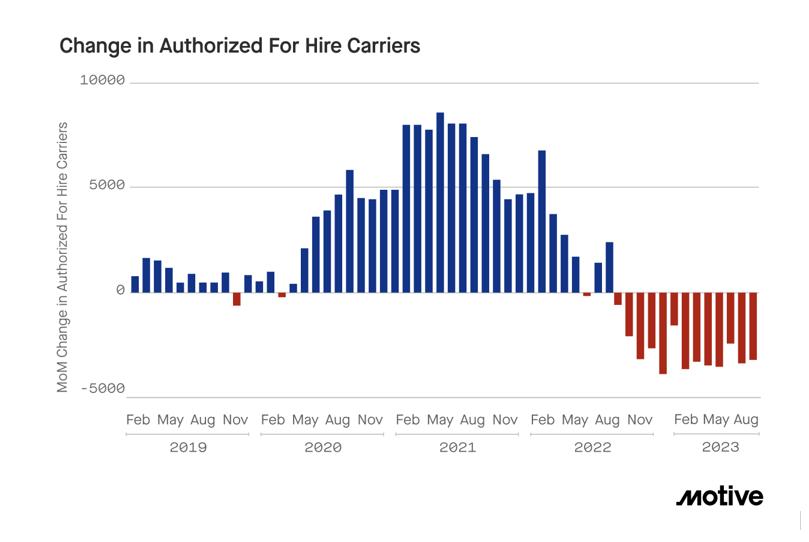

Motive’s report also reflected a continued exodus of capacity from the market, while new registrations in the U.S. hit their lowest level since June 2020. In October, 3,168 carriers left the business in the U.S., while registrations for new carriers fell 7.5% from September to the lowest mark of 2023.

“We anticipate these trends to continue through December and into Q1,” Motive wrote. “December and January will likely see more carriers closing as smaller businesses decide not to continue into the new year under the current market conditions. While carrier registrations might see a slight bump, which is typical for the start of the year, the lack of consumer demand is likely to make this continue trending downward as well. Trucking capacity needs to be more balanced with demand for freight prices to rise and market conditions to change.”

You can read the full report here.

Reefer rates rise

As Americans prepare to celebrate their Thanksgiving holiday, refrigerated freight demand on the spot market spiked, taking rates up with it. But the dry van segment isn’t showing the same strength, suggesting holiday gains may be muted this year.

Truckstop and FTR Transportation Intelligence reported that, for the week ended Nov. 3, overall broker-posted spot rates rose for just the second time since the end of August. This was thanks to those stronger reefer rates, which offset small declines in van and flatbed segments.

Good news for carriers: last week there was stronger growth in load postings than truck postings, moving the Market Demand Index up to 53.9, its strongest reading in a month.

Canadian spot market ends Q3 on positive note

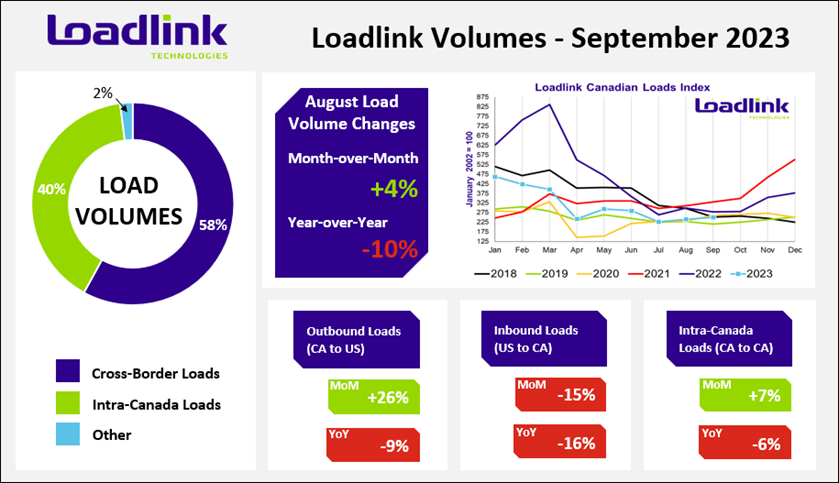

The news was also positive in the Canadian spot market in September. Loadlink Technologies reported freight volumes on its network were up, and truck postings down. It is the first time since December 2022 and January 2023 that we’ve seen two consecutive months of increased load volumes.

In September, outbound cross-border and intra-Canada load postings increased, while inbound cross-border postings declined. Southbound loads to the U.S. were particularly strong, up 26% from August levels, but still 9% off last year’s figures.

The truck-to-load ratio lowered from 5.05 trucks per load, to 4.34, a 14% decrease. But year over year, the truck-to-load ratio was up 19% from when there were just 3.64 trucks per load last September.

‘Uncomfortable equilibrium’

Before you pop those champagne bottles over improving spot market conditions, you may want to first buy some more ice. And lots of it. Because ACT Research reports in its Freight Forecast, U.S. Rate and Volume Outlook report that freight conditions will take some time to improve.

“We continue to expect the freight cycle to turn once capacity tightens, but early signs of 2024 equipment production suggest that may be a while,” said Tim Denoyer, ACT’s vice-president and senior analyst.

“The trucking industry has broadly reached an uncomfortable equilibrium with spot rates steady for several months now. Net fleet exits, which have been going on for a year, are worsening, and although equipment demand at larger fleets remains fairly robust, there are signs that lower new equipment demand will lead to a tighter freight market over the course of 2024.

“Even as the freight demand cycle should improve in 2024, the demand outlook remains soft for this winter as the industry continues to add equipment capacity into an oversupplied market. Class 8 orders over the next few months will be pivotal in setting the tone for capacity and rates in 2024.”

The last word

The freight recession (and did anyone notice the Canadian economy slipped into a technical recession with both Q2 and Q3 GDP growth coming in negative?), was a hot topic of conversation at the Truckload Carriers Associations’ Bridging Border Barriers event in Mississauga this week. David Tumber, COO of Kriska Transportation Group summed up the current realities quite succinctly. Here’s what he had to say:

“To say it’s a challenge to grow the top line might be an understatement in this environment. Eighteen months ago, two years ago, we were moving freight at a rate per mile that was exponentially higher than pre-pandemic. Fuel surcharge revenue was the highest we’d ever seen. Utilization was terrific. Seated trucks were all full. Fast-forward to where we are today and it’s obviously a different environment.

“I think it makes it difficult to achieve organic growth. Does that mean we stop trying? Of course not. There are opportunities to grow share with our existing customer base. There are opportunities with existing customers to renegotiate, to extend existing agreements, to take certain lanes off RFQs. It comes down to the relationships you have.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.