Economic Trucking Trends: Class 8 orders hold up, shipper conditions improve

Class 8 truck OEMs have yet to fully open 2024 orderboards, and strong production levels continue to eat away at the backlog. Shippers are still in the driver’s seat and are expected to continue enjoying positive conditions for the foreseeable future. And U.S spot market rates continue to bounce along what is hopefully the bottom.

Let’s take a deeper look at trucking economic indicators from the week that was.

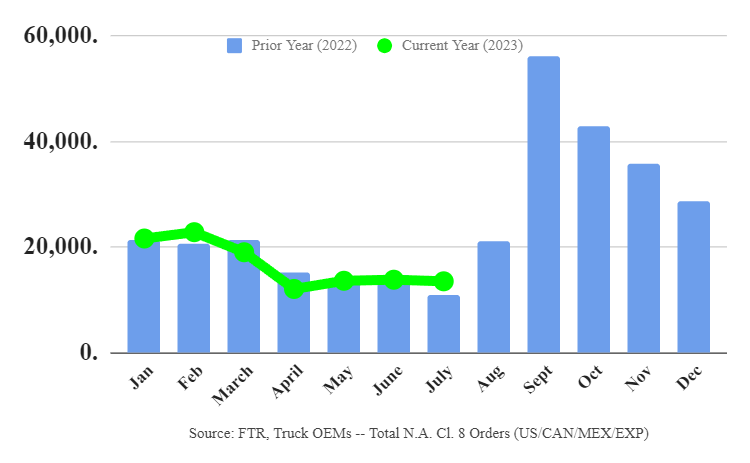

Class 8 orders hold up

Class 8 truck orders in July exceeded expectations at 13,500 units, according to preliminary data from FTR, while ACT Research reported 16,000 orders.

Taking the FTR numbers, that’s an 8% pullback from June but a 25% year-over-year increase. These order volumes are still below replacement demand, FTR reports. Orders, while surprising on the upside, were still weak and in line with seasonal weakening. Meanwhile, the backlog continues to whittle down.

“We had expected net orders to fall below 10,000 units monthly several months ago as fleets wait for OEMs to open 2024 build slots, but that did not occur,” FTR chairman Eric Starks explained. “Build slots are anticipated to open soon, so orders likely will not fall much further – if at all – in the near term. Build slots for 2023 are already filled, so it is unclear when these orders will be slotted, and the situation clearly will add pressure to increase production through the end of the year.”

July is typically the low-water mark for monthly orders, according to ACT Research.

“As represented by seasonal factors, this is the time of the year when expectations for orders are low. For both the medium-duty Classes 5-7 and heavy-duty Class 8 markets, July is the traditional low-water mark for monthly order placements,” said Kenny Vieth, ACT’s president and senior analyst. “That low expectation is reconfirmed this year as both MD and HD 2023 backlogs, as measured by backlog-to-build ratios, are essentially full. In addition to already filled backlogs constraining order flows, 2024 orderboards are not yet or just barely open, making the opportunity for bigger numbers elusive. All that said, July order activity was largely in line with or slightly above year-to-date trends.”

Spot market remains little changed

U.S. spot market rates were little changed in the week ended July 28. Dry van rates decreased just a fraction of a cent, according to Truckstop and FTR Transportation Intelligence. Reefer and flatbed rates, meanwhile, pushed upward.

Truckstop notes dry van rates tend to firm in late July and early August before pushing up modestly heading into the Labor Day holiday.

“The slight increase in flatbed rates was only the second in nine weeks, and rates are down more than 25 cents during that period,” the companies reported.

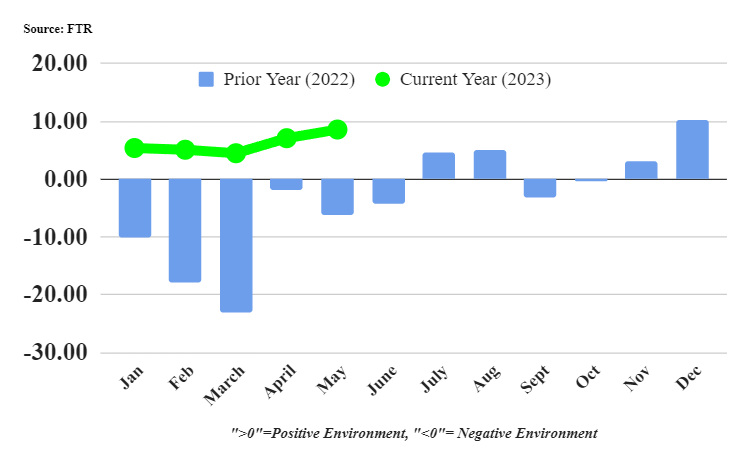

Shippers enjoy improving conditions

FTR’s Shippers Conditions Index for May rose from 7.1 to an even stronger 8.6, reflecting lower fuel costs and freight rates combined with slightly weaker freight volumes. The industry forecaster is expecting conditions to remain positive for shippers through mid-2024.

“The Shippers Conditions Index rose in May as it became more obvious that there would be abundant capacity available in the system for longer during 2023,” said Todd Tranausky, vice-president of rail and intermodal with FTR. “While there are signs that capacity may be as loose as it is going to get, economic uncertainty could keep some shippers on the sidelines as they weigh their own inventory situation.”

Muted expectations

I traveled to Winnipeg this week to report on Fastfrate’s groundbreaking at the new CentrePort Canada Rail Park. While there, I asked Fastfrate executive chairman Ron Tepper for his thoughts on freight conditions and the economy for the remainder of 2023. He said volumes are down this year, but margins are stronger. He also said he’s expecting conditions to remain “soft” for the rest of the year, notwithstanding a bump in freight as the west coast ports reopen.

That seems to be the consensus out there. Earlier this week Titanium announced its first asset-based acquisition south of the border, and on a call with analysts CEO Ted Daniel lowered the company’s guidance from a range of $500-$520 million to $450-$470 million.

However, it also bumped its adjusted EBITDA margins to 10.5%-12.5% (previously 9.5%-11.5%). The top lines of publicly traded fleets this earnings season are reflecting a sharp decrease in fuel surcharge revenue, while freight volumes have contracted, and excess capacity has put pressure on prices, but some fleets are finding ways to strengthen margins even in this difficult environment.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.